epf account 2 withdrawal for house

Withdrawing EPF Funds OfflineComposite Claim Form. Withdrawal from the Fund Am.

How To Use Epf Account 2 Money To Buy A House Iproperty Com My

Partial withdrawal before retirement.

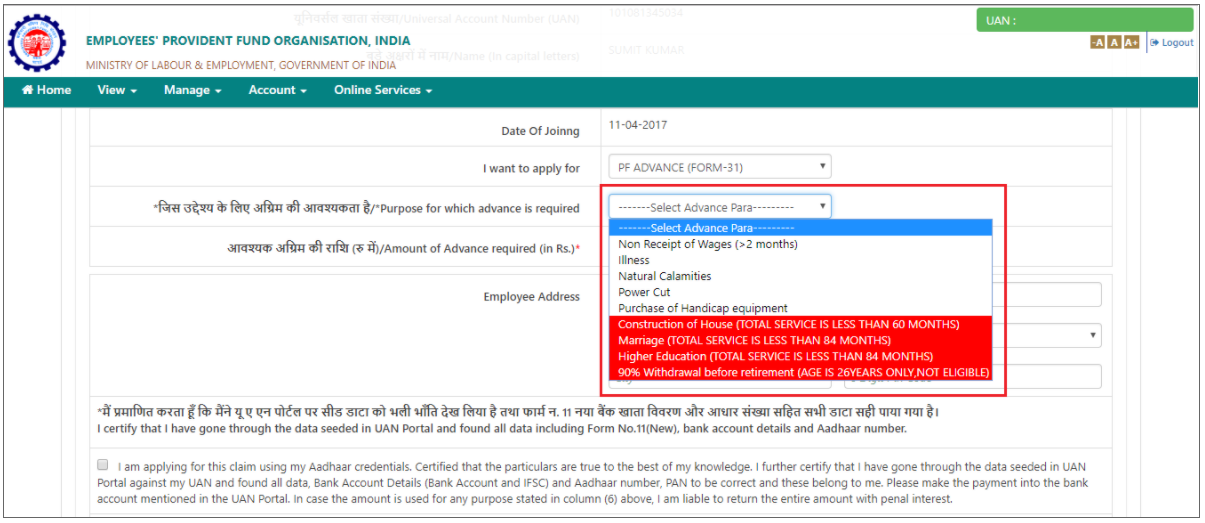

. You have to fill Form 19 for final settlement Form 31 for partial EPF withdrawal Form 10C for pension withdrawal and Form 10D for withdrawal of monthly pension. However the nominee for EDLI will be the same as it is for EPF. In March 2020 the government had announced that an individual can withdraw a certain sum from their Employees Provident Fund EPF account if faced with financial stress due to coronavirus and the pandemic-induced lockdowns.

After the 10 years of the completion of the house. You have been in India for 2 months 60 days in the previous year and have lived for one whole year 365 days in the last four years. Construction of house or land purchase 4.

Income from house property. In March 2020 the government had announced that an individual can withdraw a certain sum from their Employees Provident Fund EPF account if faced with financial stress due to coronavirus and. Deleted by Act A13002007.

Over a year later in May 2021 the labour ministry announced that EPF members can avail a second non-refundable advance from their. As per current law an employees own contribution to the EPF account is not taxable. Documents Required for EPF Withdrawal Online.

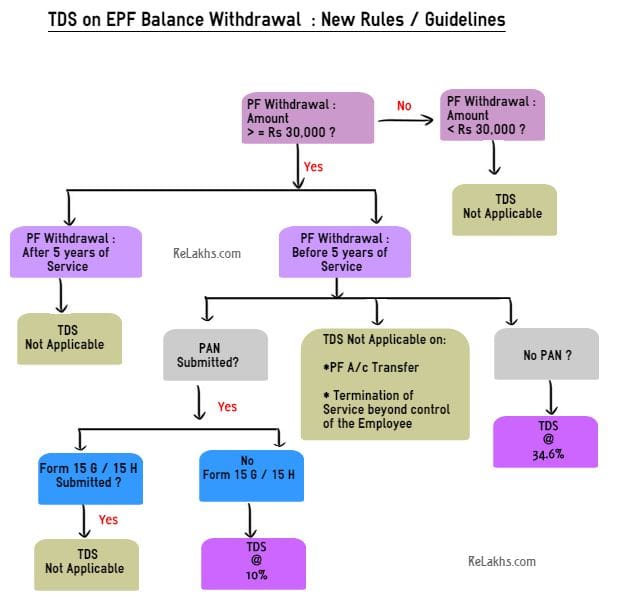

Up to 90 of accumulated balance. 36 months basic wage plus Dearness Allowance. As per the Budget of 2016-17 and the Finance Act 2016 the threshold of Provident Fund withdrawals was raised from 30000 to Rs.

A few years before retirement. Thanks to UAN accessing your PF account services like withdrawal checking EPF balance without the help of an employer and PF loan application is easy. However effective from April 1 2020 onwards employers contribution to the EPF account can become taxable if it exceeds Rs 75 lakh in a financial year.

This interest is also subject to TDS under section 194A. 50000 for Tax Deducted at Source amended under section 192A of Income Tax Act 1961. Complaints related to EPF withdrawal transfer of EPF account know-your-customer KYC related issues and so on can be filed through this website.

Click on the For Employees option available in the Services menu. To purchase a house flat or to construct a residential property. As per the EPF scheme rules a person can nominate different persons in hisher EPF and EPS accounts.

All about PF balance check with UAN number. However 12 of the employer contribution does not go to the EPF account. Starting FY 21-22 interest on employees contribution to an EPF account above Rs 25 lakh during the financial year is taxable in the hands of the employee.

According to EPF rules 833 percent of the employers contribution is diverted towards EPS account. They do not have to wait for the employer to share the Employees Provident Fund EPF statement at the end of the year to know the balanc You can check your EPF balance using any of these facilities. PF withdrawal conditions to keep in mind.

As per the newly added Para 68-BD in the EPF Scheme 1952 EPF members can apply for a withdrawal of up to 90 of the accumulated corpus for either making the down payment of the house or for the payment of. Employees should arrange 2 revenue stamps a valid bank account statement Aadhaar Card PAN Card Voter ID. 24 months basic wage and Dearness Allowance.

It is compulsory for all employees who draw a basic salary of less than Rs 15000 per month to become members of the EPF. The accumulated funds from the EPF account including the employee and employers share. The Employees Provident Fund Organisation EPFO has a dedicated website EPF i Grievance Management System where EPF account holders can file their complaints.

Universal Account Number UAN is important for EPF account holders as the entire process related to the Employee Provident Fund EPF services are now operated online. When contribution to EPF account becomes taxable. If the mentioned bank account number in the EPF account is closed or inactive then there can be a delay when you apply for withdrawal claims.

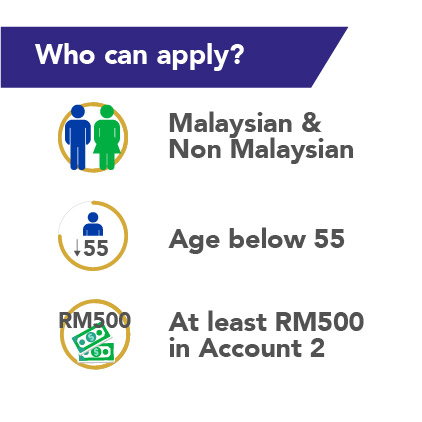

At least 5 years of contribution to the PF account is a must to withdraw PF money for house purchase. Income from FDs and bank account. The Employees Provident Fund Organisations Member e-Sewa website offers provident fund members various services onlineSome of the services that you as an Employees Provident Fund EPF member can avail on the website are.

Act A10802000 The Board may authorize the withdrawal of all sums of to the credit of a member of the Fund upon any terms and conditions as may be the Board if the Board is satisfied that- the member of the Fund has died. Repayment of home loan 6. The labour ministry has announced that EPF members can now withdraw twice from their EPF account to meet the emergency expenses arising due to the Coronavirus pandemic.

EPF members can utilize the fund accumulated in their EPF account to facilitate their housing needs after three years of account opening. According to the latest norms an EPF account becomes inoperative if the employee does not make an application for withdrawal of the accumulated EPF balance. News Update 1 st June 2021.

This portal can be used by an EPF account. Kasturirangan says The lump sum complete withdrawal from EPF and EPS account provided number of years of service is less than 10 years can be done at the time of closing of account in the event of job-loss and remaining unemployed for over 2 months or at the time of retirement death or due to permanent and total disability of member. Even after completing 36 months from the time of retirement after the.

TDS on EPF Withdrawal. The Employees Provident Fund EPF members should ensure that their bank account details are up-to-date correct and that their EPF account is active. EPFO stipulates that individuals should possess vital documents before applying online for EPF withdrawal.

Any employee who contributes to an EPF account can check the balance in hisher EPF account via online channels. PF withdrawals within 5 years of opening an account are taxable 2. EPFO allows members to withdraw money from EPF Account twice to meet COVID-19 Emergency.

Umang App EPFO Member e-Sewa portal. How to Check EPF Interest Amount in PF Account Using EPFO Online Portal. You cant withdraw PF balance from your current job.

The notified foreign countries tax it at the time of withdrawal or redemption of. Only 367 percent of the employers contribution is added to the members provident fund account along with members own contribution at the. Further the condition to avail the minimum assurance benefit of Rs 25 lakh for eligible family members of the deceased employee has been tweaked.

Out of the 12 contribution 833 goes towards the Employee Pension Scheme Account and the remaining 367 goes to the employee EPF account. PF withdrawal for a particular purpose. Frequently Asked Questions FAQs.

You can withdraw money from your PF account to buy a home even if it is being registered solely in the name of your spouse or jointly in your and your spouses name. The composite claim form is a combination of Form 19 Form 31 Form 10C and Form 10D. Here are a few simple steps to help you check your EPF interest amount in your PF account using the EPFO online portal.

Visit the EPFO login portal at epfindiagovin. Viewing and downloading EPF passbook filing a claim for withdrawal of money for various purposes meeting financial. EPF withdrawal for covid-19 advance.

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

18 Types Of Epf Withdrawal You Should Know Munhong Com

New Pf Withdrawal Form Single Form To Withdraw Epf New Features

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

You Can Withdraw 75 Of Employees Provident Fund For Covid 19 Pandemic Soon Check Details The Financial Express

Pf Partial Withdrawal Rules House Purchase Renovation Home Loan

Epf Withdrawals New Rules Provisions Related To Tds

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

How To Withdraw Epf Money Online Amid Covid 19 Outbreak

How To Apply For Epf Withdrawal From Account 2 For Education Eduspiral Consultant Services Best Advise Information On Courses At Malaysia S Top Private Universities And Colleges

Chapter 7 Retirement Planning Flashcards Quizlet

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

You May Soon Be Able To Withdraw 90 Of Provident Fund Money To Buy A House Businesstoday

0 Response to "epf account 2 withdrawal for house"

Post a Comment